Auto-Renewal & Deceptive Billing Practices Lawyer

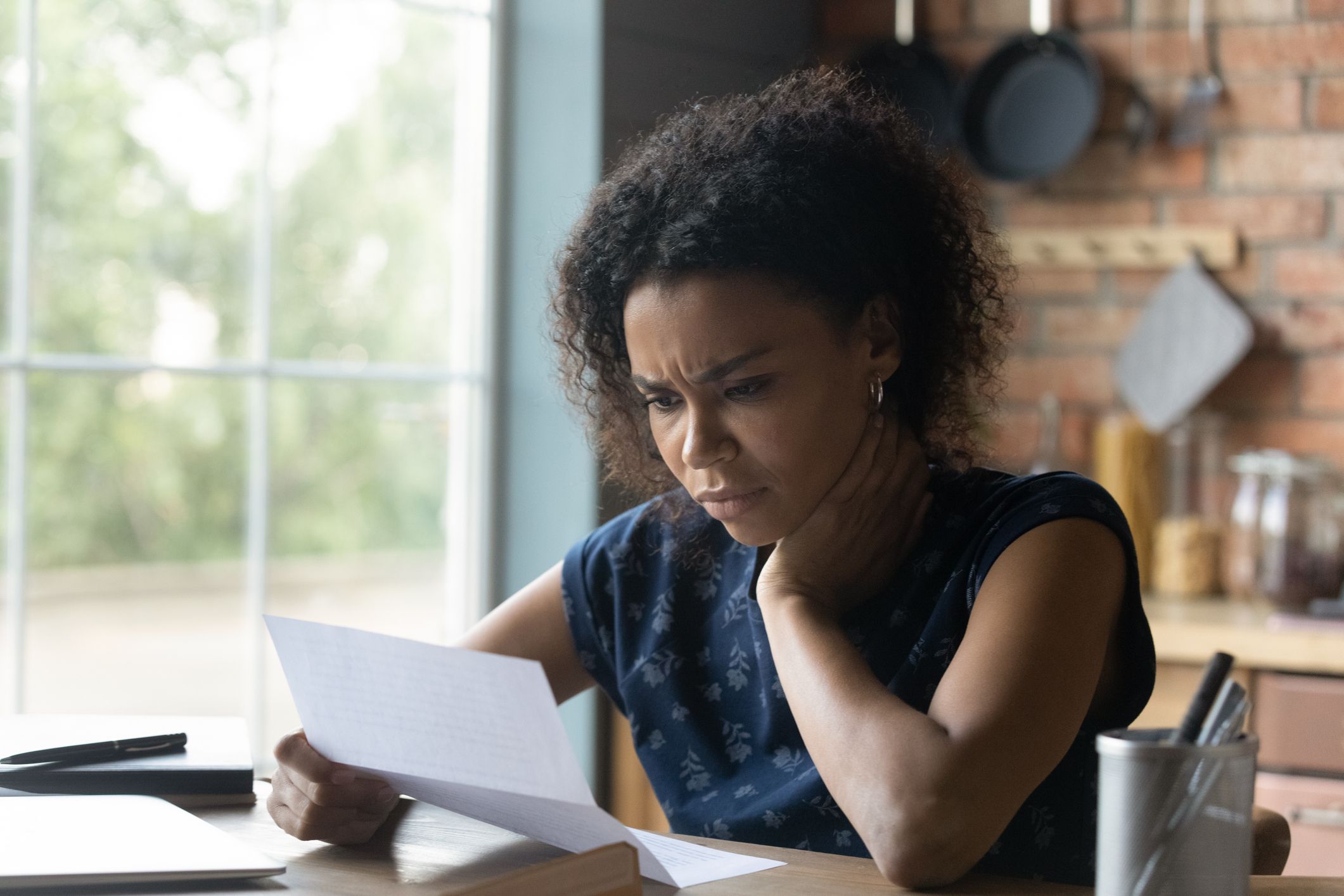

Can an Auto-Renewal & Deceptive Billing Practices Lawyer Help You?

When companies engage in illegal subscription auto renewal and recurring payment schemes, a deceptive billing practices attorney can help you fight back.

Each year, more and more purchases are made online, where the fine print and opt-in/opt-out buttons create confusion for buyers. In some cases the confusion is intentional, and could lead to devastating financial losses. If you were misled, signed up for auto-renewal billing you did not want, or have issues with persistent recurring charges, a lawyer may be able to help.

Consumer protection attorneys can help with cases of subscription auto-renewal schemes, deceptive billing, and other forms of unlawful recurring charges or fraud.

Subscription auto-renewal billing fraud is not new, but the practice is still largely possible due to the lack of consumer protection laws on the books. If you have been a victim of deceptive billing fraud due to illegal recurring payments, unauthorized charges, or unlawful auto-renewals, we can help.

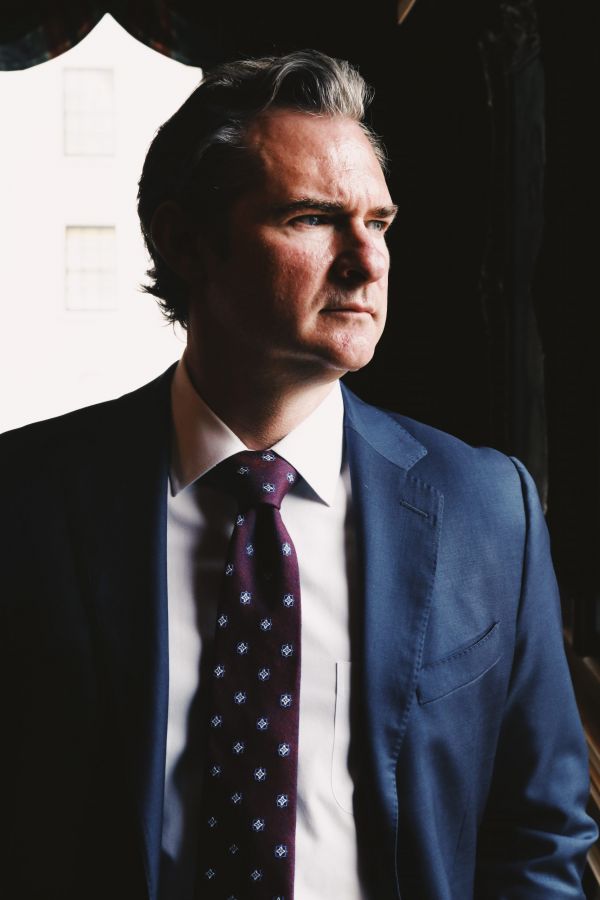

The Lyon Firm is headquartered in Cinncinati, OH, where we investigate far-reaching class action claims related to consumer fraud. Our founder Joe Lyon is a class action consumer protection attorney with extensive experience in filing subscription billing fraud and automatic renewal complaints on behalf of plaintiffs nationwide.

Speak with us right away at (513) 381-2333, or by filling out our online contact form to schedule an appointment. The sooner you have professional representation on your side, the faster we can close this case, and recover what was unfairly taken from you. Additionally, your case could help alert others that they are being robbed, and have the ability to stop the fraud and gain justice.

What Can a Deceptive Billing Lawsuit Cover?

“Deceptive billing” or fraudulent billing is a broad term which includes auto-renewal schemes. Essentially, it is the fraudulent act of charging or invoicing funds from a person or entity without showing their obligation to pay. Auto-renewal is a form of deceptive billing that is carried out by algorithms and machines with little-to-no direct human oversight.

Deceptive billing, auto-renewal, and financial fraud settlements or verdicts could cover:

- Economic Damages: A reimbursement of the money you were charged under the “out-of pocket” rule, which means restoring a defrauded person the financial position they were in before the fraud occurred. Other monetary losses may be covered as well, such as if you lost a business or loan opportunity as a result of the incident.

- Mental Anguish Damages: Fraudulent or unauthorized billing activity causes enormous amounts of stress if it means a person cannot cover necessary expenses (like rent). A person could also reasonably assume they were the victim of identity theft, and spend time and effort trying to fix their accounts. The psychological impact of fraud also deserves compensation.

- Attorneys’ Fees: A settlement or verdict can explicitly cover your attorneys’ fees in addition to your damages, so they do not come out of your share of the award.

An experienced financial fraud attorney will work to see that you’re compensated both economically and emotionally. Our goal at The Lyon Firm is to see our clients are not only refunded their money, but also made whole after the ordeal of being defrauded. Call us today at (513) 381-2333 to discuss your specific situation, and what you need to make it right again.

Auto-renewal and deceptive billing cases often involve a vast amount of customers or consumers, and could lead to a class-action lawsuit. Your choice to pursue your case could help alert others to fraud, and prompt a class-action suit that brings positive industry-wide change. See the FAQs for examples of influence class-action victories.

How Do I Fight Automatic Renewal?

Here are the first steps you can take to stop the bleeding of funds if you’ve discovered recurring auto-renewal charges on your accounts:

- Opt out: If you can log into an account, contact customer service support, or find your original contact, you may be able to cancel the renewal process right away.

- Stop payment: If you cannot access your account or get in touch with the entity charging you, contact your bank or credit union to put a “stop payment” order on your account. The bank may charge a fee, but it’s important to halt the access to your account as soon as possible. The cost of this fee can be part of your damages in a later lawsuit, so we advise keeping a record of it.

- Contact an attorney: Once your accounts are protected, a consumer fraud lawyer can help you with everything that follows, including formally disputing charges, sending cease and desist letters to the company charging you, and filing a claim for your losses.

Your first priority is to stop or block the charges so they cannot take any more of your hard-earned money. After that, you have legal options to recoup your losses and hold the individual or company responsible for their fraudulent or deceptive activity.

Can I Dispute a Charge for Auto-Renewal?

Yes, you can dispute an auto-renewal charge. You can do so by:

- Lodging a dispute with your card issuer or bank

- Recording a complaint with the Better Business Bureau (BBB)

- Reporting fraud to the Federal Trade Commission (FTC)

- Filing an individual personal injury lawsuit for financial damages

- Joining a class-action consumer fraud lawsuit

An attorney can help provide guidance throughout each of the above steps. Another option is to look into subscription management apps that help you identify and cancel unused or unauthorized subscriptions before they drain your bank account.

Businesses and companies are not above the law. If you’ve been taken advantage of by unfair or fraudulent practices, reach out to The Lyon Firm at (513) 381-2333. We will stand by your side to help assert your rights and recover what you’re owed.

What Are the Four Areas of Unethical Billing Practices?

Automatic renewals of online services, apps, and other subscriptions are extremely commonplace. While many find auto-billing convenient for specific recurring payments like loan payments or utility bills to avoid late fees or service interruptions, some companies have a business model that is inherently fraudulent.

This is not a new phenomenon. Here are four areas of unethical billing practices that span multiple industries:

- “No-risk” or “no payment” free trial offers may intentionally fail to clearly disclose automatic renewal charges. The information about recurring payments is often hidden in fine print, or extorted with the use of pre-checked boxes for online transactions. That means consumers who may intend for a one-time purchase or free trial promotion are suddenly facing months or a full year of unauthorized charges.

- Unlawful cancellation processes are also very common, meaning it’s easy to sign up, but unfairly difficult or even impossible to cancel. Think of cable subscriptions and gym memberships that require in-person cancellation even if you signed up online or by phone.

- Phantom charges that bill for services that were never actually rendered. These are seen in areas like medical billing, credit card offers, airline bookings, hotel services, and vehicle maintenance. Charges for items you did not use in the rooms where you stayed, or fees for insurance coverages or invisible treatments you did not request, need, or actually receive.

- Upselling or upcoding (medical), which is the practice of upgrading the charge on your bill while still delivering the lower-grade service or item. So-called “deluxe” versions, boosted ingredients, or a larger-sized package that contains the same units of a product as the smaller size.

Auto-renewals are just one aspect of the deceptive billing practices that plague consumers. Call our office at (513) 381-2333 so we can thoroughly investigate your case and identify the full extent of your situation.

If you identify a deceptive billing issue, you’re likely not the first person impacted. Contact an attorney to discuss your options for justice — by doing so, you’re already helping to spread the word and put a stop to unfair practices.

Contact an Experienced Financial Fraud Attorney

Many states and consumer oversight agencies have agreed that companies which automatically bill customers for products or services on a recurring basis must clearly disclose the terms of the offer. They must present automatic renewal terms in a clear and conspicuous manner, obtain consumers’ consent, and provide customers with a simple cancellation mechanism.

Unfortunately, the regulatory powers behind these rules are not as strong as they should be, and companies hope to slip through the cracks with your money. A consumer fraud lawsuit can hold them accountable.

At The Lyon Firm, we have decades of experience working to protect consumers from fraud, from cybersecurity data breaches to defective medical devices. Our case results include:

- $9.25 million for an invasion of privacy (TCPA) class action

- $4.2 million for a data breach class action

- $4 million for a deceptive sales practice class action.

A consumer’s consent to automatic renewal terms is required. The cancellation policy must be clear and easy, and the company must provide a toll-free telephone number, e-mail address, and postal address. If it is not, and you’ve been unfairly charged, you have rights under the law.

The Lyon Firm stands ready to help. Contact our offices directly by calling (513) 381-2333, or fill out our online contact form. Please provide any details you’re comfortable sharing, or schedule an in-personnappointment at your earliest convenience. You do not have to tolerate fraudulent behavior — empower us to work on your behalf, and seek the compensation you deserve.

Auto-Renewal & Deceptive Billing Practices FAQ

Industries that have frequent deceptive billing issues include:

- Health insurance

- Mobile phone companies

- Health apps

- Gaming apps

- News sites

- Dating sites

- Gym memberships

- Many other online services

One of the more common illegal billing practices is when a company does not clearly disclose automatic charges when a trial period ends. Any convoluted, confusing, and unnecessarily lengthy cancellation process may be a federal consumer protection violation.

We encourage consumers to always look beyond the surface level of all promotions, and take a second look at any subscription that is listed as a “trial” or “free.”

There have been several subscription auto-renewal settlements in recent years, including the following:

- A $62 million settlement with Noom Inc after customers alleged that the weight loss app provider deceived customers into signing up for “risk-free” trial periods, which fed them directly into costly auto-renewals that were difficult to cancel

- A $22.5 million lawsuit against the company behind Bumble to resolve allegations that it violated consumer protection laws by improperly autorenewing subscriptions without consent

- A $3.8 million settlement against Sirius XM Radio over auto-renewal charges

Another notable case includes a class action settlement agreement in California in which plaintiffs alleged the Washington Post violated state laws by automatically renewing customers’ newspaper subscriptions without asking for prior consent.

Auto-renewal laws govern the ways in which companies can sell products and services that involve a subscription. There are specific components that must be included in subscription automatic renewal contracts:

- Clear disclosures about the offer: Companies must present the terms of any automatic renewal offer “clearly and conspicuously.”

- Disclosures about the contract period: The contract period must be clearly presented prior to consumer purchase.

- Obtaining consent: Consent must be “express” and “informed.” Written consent is voluntarily given by a competent individual after details of the offer have been disclosed.

- Written confirmation following a purchase: Written acknowledgment must be given to the customer after a purchase, and must include the initial disclosures, and specific information on how to cancel. If a free trial is offered, this must also include details on how to cancel the subscription before being charged.

- Cancellation mechanisms must be simple: Methods to cancel a subscription must be cost-effective and easy.

Renewal reminders must also be timely. These vary by state, but companies should send proper notice to customers before their subscription is automatically renewed.

It’s beneficial to file a class action when the amount of money in dispute for a single plaintiff would not justify the expense of litigating the case, but the amount of damages for the entire class of Plaintiffs would justify the cost of litigation. Moreover, without class actions, large corporate defendants would be able to cause harm over a large group of individuals without any risk of penalty.

The American consumer has the right to privacy, fair and lawful business practices, and safe consumer products. When companies engage in deceptive billing practices and violate consumer protection laws, they may be held liable in consumer fraud and consumer protection class action lawsuits.

The Lyon Firm represents plaintiffs in a wide variety of consumer protection class action litigation, and settles cases for clients on a contingency basis. Contact us at (513) 381-2333 to discuss the details of your circumstances and your legal options. Our founder Joe Lyon is a highly-rated consumer fraud attorney, representing plaintiffs nationwide in individual claims and consumer protection class action lawsuits. When companies place profit before the safety of the consumer, you can help correct them via the law.

CONTACT THE LYON FIRM TODAY

Please complete the form below for a FREE consultation.

ABOUT THE LYON FIRM

Joseph Lyon has 17 years of experience representing individuals in complex litigation matters. He has represented individuals in every state against many of the largest companies in the world.

The Firm focuses on single-event civil cases and class actions involving corporate neglect & fraud, toxic exposure, product defects & recalls, medical malpractice, and invasion of privacy.

NO COST UNLESS WE WIN

The Firm offers contingency fees, advancing all costs of the litigation, and accepting the full financial risk, allowing our clients full access to the legal system while reducing the financial stress while they focus on their healthcare and financial needs.

Why File A Consumer Fraud Case?

Without consumer fraud class actions, large corporate defendants would be able to cause small amounts of harm over a large group of individuals without any risk of monetary penalty.

CONTACT THE LYON FIRM TODAY

Consumer Rights & Justice

Understanding Automatic Renewal Lawsuits

Filing a Consumer Fraud lawsuit is a complex and serious legal course and can carry monetary sanctions if the proper legal process is not followed. The Lyon Firm is dedicated to assisting plaintiffs work toward a financial solution.

We work with law firms across the country to provide the most resources possible and to build your case into a valuable settlement. The current legal environment is favorable for consumers involved in data breach class actions, deceptive marketing lawsuits, TCPA telemarketing claims, automatic renewal lawsuits, and various subscription billing fraud claims.

Consumer Fraud Settlements

We work with law firms across the country to provide the most resources possible and to build your consumer fraud case into a valuable settlement.

Direct Buy Settlement

$6,000,000

(United States District Court for Connecticut)

Direct Buy

The Lyon Firm represented the primary class representative and participated in the Class Action alleging Direct Buy’s Accredited Partner plan was false and misleading due to a “kickback” program that was undisclosed.

Direct Buy resolved the case denying all allegations. The settlement covered class members who were members during the class period.

Consumer Protection Class Action

Consumers have rights in the USA, and when companies do not provide a service they have promised, or hold up their end of a bargain, legal action may be necessary. Consumer protection attorneys work on your behalf to hold companies responsible for providing a fair and safe service.

The Lyon Firm has worked with law firms nationwide in consumer class actions involving deceptive marketing, false advertising, food mislabeling and misleading marketing claims.

Automatic Renewal Investigations

- American Automobile Association (AAA)

- Our State Magazine – North Carolina

- Virginian Pilot

- Albuquerque Journal

- Financial Times

- Chicago Daily Herald

- Washington Times

- Crain’s Chicago Business

- VISN

- National Review

- Philo TV

- The Atlantic (Atlantic Monthly)

- Future Publishing Company

- JustAnswer.com

- SeaWorld

-

-

Answer a few general questions.

-

A member of our legal team will review your case.

-

We will determine, together with you, what makes sense for the next step for you and your family to take.

-