EMPLOYEE MISCLASSIFICATION

Class Action Labor Attorney

Gain Compensation for your experience

The Internal Revenue Service (IRS) estimates that American employers intentionally misclassify millions of workers as independent contractors to reduce labor costs and avoid paying state and federal taxes.

Employee misclassification allows large corporations can save on the bottom line, but at the expense of workers. Misclassified employees lose workplace protections, including the right to join a union, face an increased tax burden, receive no overtime pay, and are often ineligible for unemployment insurance and disability compensation.

According to a 2012 study by the National Employment Law Project, there were an estimated 368,685 misclassified workers in Illinois, 704,785 in New York, and up to 459,000 in Ohio.

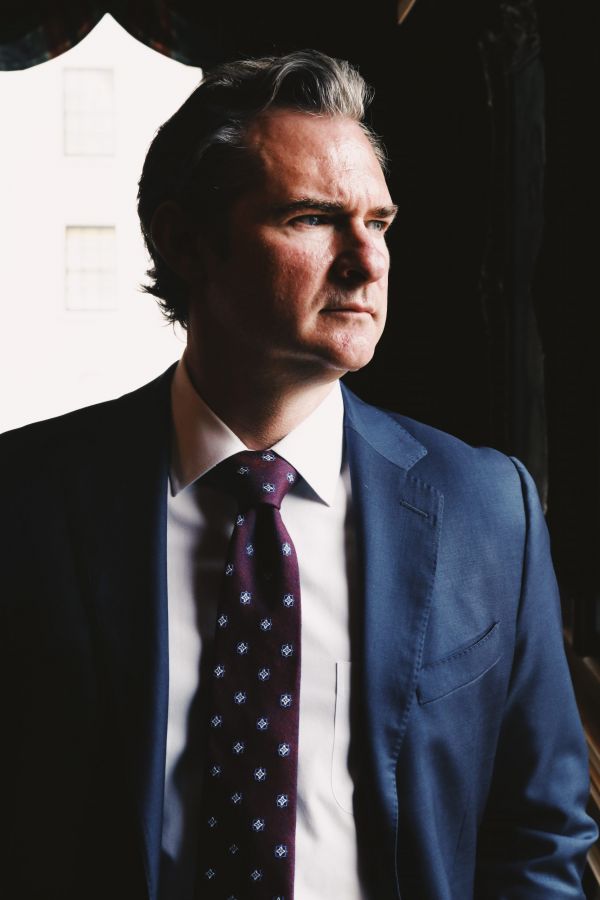

Joe Lyon is a highly-rated lawyer representing plaintiffs nationwide in a wide variety of labor disputes and employee misclassification lawsuits.

Employee Misclassification Lawsuits

An independent contractor provides a good or service to another individual or business, often under the terms of a contract that dictates the work outcome, but the contractor retains control over how they provide the good or service.

The independent contractor is not subject to the employer’s control or guidance except as designated in a mutually binding agreement. Essentially, independent contractors treat their employers more like customers or clients, often have multiple clients, and are self-employed.

A worker’s status is generally determined by whether the individual is economically dependent on the business he or she is working for, or is actually in a business for themselves. Some basic questions can be asked to make a determination as an employment status:

• Does the company control what a worker does or how a worker performs duties?

• Are financial aspects of the work, such method of payment and reimbursement of expenses, controlled by the worker or the company?

• Is there a written contract?

• Does the worker receive employee-type benefits, such as a pension plan, insurance, or vacation pay?

Why Do Employers Misclassify Workers?

There are several reasons an employer might consider misclassifying workers, the most pertinent of which are outlined below:

• Misclassifying employees as independent contractors can free employers from providing a minimum wage, and abiding by hour laws.

• Tax savings: Employers are not required to pay Social Security and unemployment insurance (UI) taxes for independent contractors. These tax savings, as well as savings from income and Medicare taxes can save employers between 20 to 40 percent on labor costs.

• Employers may avoid laws enforced by the Equal Employment Opportunity Commission (EEOC).

• Employers can avoid union organization. Independent contractors are not covered by the National Labor Relations Act.

• Employers save money on company provided benefits as independent contractors are usually not permitted to enroll in employer-based health and pension plans.

• Employers may avoid having to verify that workers are U.S. citizens or covered by a work visa, and exploit low-wage immigrant workers with few legal repercussions.

CONTACT THE LYON FIRM TODAY

Please complete the form below for a FREE consultation.

ABOUT THE LYON FIRM

Joseph Lyon has 17 years of experience representing individuals in complex litigation matters. He has represented individuals in every state against many of the largest companies in the world.

The Firm focuses on single-event civil cases and class actions involving corporate neglect & fraud, toxic exposure, product defects & recalls, medical malpractice, and invasion of privacy.

NO COST UNLESS WE WIN

The Firm offers contingency fees, advancing all costs of the litigation, and accepting the full financial risk, allowing our clients full access to the legal system while reducing the financial stress while they focus on their healthcare and financial needs.

Fed Ex Misclassification Lawsuit

In June, 2016, FedEx Ground Package System Inc. agreed to pay drivers in 20 states $240 million to settle lawsuits claiming the company misclassified them as independent contractors. FedEx saved on taxes, fringe benefits, health care costs, and pensions. Estimates suggest that FedEx cuts its labor costs by as much as 40 percent by misclassifying the drivers.

The drivers claimed that as employees they were owed overtime pay and reimbursement for expenses, among other benefits. The settlement is meant to be divided among 12,000 drivers, some of whom are owed tens of thousands of dollars.

Uber Misclassification Lawsuit

Both Lyft and Uber are facing separate employee misclassification lawsuits, brought on behalf of drivers who contend they are entitled to reimbursement for expenses including gas and vehicle maintenance. The drivers currently pay those costs themselves.

In April 2016, Uber decided to settle a class action lawsuit for brought against it by drivers in California and Massachusetts for $100 million. The independent contractor dispute has not been resolved, however, as a judge has ruled that the settlement is significantly lower than the actual value of the case.

Earlier in the year, Lyft agreed to settle a similar class action lawsuit in California by giving drivers additional workplace protections but without classifying them as employees. The settlement agreement provides for Lyft to pay $12.25 million, though is also being reconsidered by the courts.

Worker Misclassification Settlements

In April, 2015, the Department of Labor announced that it recovered $700,000 in back wages, damages, and penalties for over 1,000 misclassified construction industry workers in Utah and Arizona.

In September, 2014, a California court ruled that The Sacramento Bee misclassified over 5,000 newspaper carriers as independent contractors.

According to Department of Labor statistics, the most common Ohio employee misclassification claims include the following:

• Construction workers

• Delivery/couriers

• Stocking vendors

• Maintenance workers

• Food processing plant workers

• Dental assistants

• Waitresses

• Nail salon techs

• Nurses

• Secretaries

• Landscapers

• Pharmaceutical sales reps

Independent Contractor Lawsuits

Workers who are misclassified are taken advantage of in several ways. Some of the costs of being misclassified as an independent contractor may include the following:

• Missing out on compensation insurance, pensions, and medical benefits

• No meal and rest breaks required by law

• No required medical and pregnancy leave

• No protection by the anti-discrimination and anti-harassment laws. Only employees have “whistleblower” protections against retaliation

• No guarantee of continuing employment on return from a medical leave

• Exclusion from participation in profit sharing or stock options

• No reimbursement of your actual expenses associated with the employment

• You may be liable in a lawsuit for personal liability because you caused injury to a third-party during the performance of your so-called “independent contractor” duties

Why are these cases important?

Without class actions, large corporate defendants would be able to cause small amounts of harm over a large group of individuals without any risk of monetary penalty.

CONTACT THE LYON FIRM TODAY

Questions About Class Action Lawsuits

A Class Action is a lawsuit brought by an individual on behalf of all other similarly situated individuals. Rule 23 of the Federal and State Rules of Civil Procedure allows for Class Action lawsuits to resolve disputes in an efficient format.

Class Actions are typically filed when the amount of money in dispute for a single plaintiff would not justify litigating the case, but where the amount of damages of the entire class of Plaintiffs would justify the cost of litigation. Without class actions, large corporate defendants would be able to cause small amounts of harm over a large group of individuals without any risk of monetary penalty.

A Class Action lawsuit involves a large group of people that have experienced extremely similar outcomes. Because the cases must meet the strict guidelines of the Class Action, they are presented under one plaintiff.

In a Mass Tort, individual experiences may vary. Even though a large number of people have been affected, the variations from case to case are more broad than a class action. In a Mass Tort each plaintiff is represented independently, though in most instances there is still a set of general criteria to meet.

In order for a case to be certified as a Class Action, the Court must determine that the case is appropriate for class action treatment under Rule 23. There are different elements depending on whether the case is seeking monetary or injunctive relief. In general, the Court must find the following elements are satisfied:

- Numerosity: The proposed class must be so numerous that simply joining the individual plaintiffs would be impractical. Generally, the class size should exceed 100 individuals.

- Common Questions of Law or Fact: The facts and/or legal questions in the dispute must be common to all class members. This does not mean all facts or issues must be identical, but the primary facts and law that will determine the issue in dispute must be common among all class members.

- Typicality: The named Plaintiff in the case must have the same facts and legal issues as the class they are proposing to represent. If the Plaintiff’s individual case involves issues of fact or law unique to that Plaintiff and are irrelevant to the ultimate issue, class certification may be denied by the Court.

- Plaintiff/Counsel Adequately Represents the Class: The Court must find that the Plaintiff and Plaintiff’s Counsel are competent and will protect the class’ interests.

- Predominance: Common questions of fact predominate over individual facts.

- Superiority: The Class Action is a more efficient and fair means of resolving the dispute. The Court will look at the following factors when making this determination: (1) Class Member interest in maintaining a separate action; (2) the extent of any litigation already begun by other class members; (3) desirability or undesirability of litigating the case in a particular Court ; (4) difficulties in managing the class.

Medical Device Litigation, Pharmaceutical Litigation, and other toxic tort litigation is not appropriate for Class Action treatment. Specifically, cases that involve injuries to the parties contain too many individual facts in terms of the science and causation to find that the common issues predominate over the individual facts.

On the other hand, complex litigation that impacts many individuals and contain common questions of fact related to the conduct of the defendant are often appropriate for mass tort consolidation. Mass Tort consolidation in federal multi-district litigation or a State mass tort docket, allows the parties to utilize the efficiency of class action litigation through the discovery process but still allows the parties to litigate their cases individually on the critical issues of whether the conduct caused the alleged injuries.

While our human bodies are very similar, each individual’s body may have reacted differently to the toxic exposure that makes Class Action treatment inappropriate in most personal injury lawsuits.

Some toxic tort areas that may be beneficial for class action lawsuits can involve environmental contamination. When companies are negligent and contaminate large swaths of private property. Public nuisance lawsuits have been filed against negligent agricultural operations of fracking companies.

Watch our Video About the Process

Filing Class Action lawsuits is a complex and serious legal course and can carry monetary sanctions if proper legal course is not followed. The Lyon Firm is dedicated to assisting injured plaintiffs work toward a financial solution to assist in compensating for medical expenses or other damages sustained.

We work with law firms across the country to provide the most resources possible and to build your case into a valuable settlement. The current legal environment is favorable for consumers involved in data breach class actions, deceptive marketing lawsuits, TCPA telemarketing claims, and financial negligence claims.

-

-

Answer a few general questions.

-

A member of our legal team will review your case.

-

We will determine, together with you, what makes sense for the next step for you and your family to take.

-