Employer Tip Theft Attorney

A Tip Theft Lawsuit Can Help You Recover the Wages You Are Rightfully Owed

A wage-and-hour lawyer can help you understand employment law and help you bring a lawsuit.

For many workers, particularly those in service industries, tips serve as a crucial source of supplemental income. Base wages in these industries may be very low, and tips provide employees with additional earnings to help cover living expenses, support their families, or achieve financial goals.

In some service industries, the ability to earn substantial tips can be a pathway to higher-paying positions. Workers who consistently deliver outstanding service and receive positive feedback from customers may have opportunities for promotion, increased responsibility, or access to higher-paying positions within their field.

The reason employers can offer a low minimum wage to service employees is the potential for a healthy amount of tips. When employees do not earn at least minimum wage with tips, employment law requires that the employer make up the difference. Service staff have made numerous allegations that employers are failing to compensate employees or are involved in violations of tip-pooling laws.

Unfortunately, employers might disregard labor laws or deliberately participate in schemes to withhold tips, depriving staff of hundreds of millions of dollars annually. In these instances, federal labor law is clear: employers may not keep tips received by their employees under any circumstances. Tips are the sole property of the individual employee who earned the tip.

If you suspect that your employer has violated tip-pooling laws or has withheld tips that you rightfully earned, you may have cause to pursue a lawsuit. Contact The Lyon Firm online or by calling us at (513) 381-2333. We have handled many employment law cases and are here to answer all of your questions and help determine if a lawsuit is the right choice for you.

Financial Compensation in a Tip Theft Lawsuit

The Fair Labor Standards Act (FLSA) mandates that tips belong to the employees who directly receive them. This law applies to those who work in the service industry such as servers, bartenders, and other tipped employees. Employers are not allowed to take or keep any portion of these tips for themselves.

In some specific circumstances, tip-pooling may be allowed but employers must follow very specific guidelines. If your employer uses a tip-pooling system and you believe tip-pooling laws have been violated an employment lawyer can help determine if you have cause for a lawsuit.

In a tip theft lawsuit, several different types of compensation may be available for you. These types of compensation may include:

- Unpaid tips: This is the most common form of compensation in a tip theft lawsuit. Compensation includes the amount of tips wrongfully withheld by the employer. This includes tips that were unlawfully taken by managers or supervisors, tips diverted into illegal tip-pooling arrangements, or tips not distributed to employees as required by law.

- Back pay: Back pay includes any wages or tips that an employee should have received but were denied by the employer’s unlawful actions. This may include unpaid wages, overtime pay, or other compensation owed to the employees as a result of the tip theft.

- Interest on unpaid wages or tips: Employees may seek interest on the unpaid wages or tips owed to them. The amount of interest is usually calculated from the date the wages or tips were due to the date of the court judgment or settlement.

- Punitive awards: In cases of serious misconduct or intentional violation of labor laws, employees may seek punitive awards. Punitive awards are intended to punish the employer and deter similar behavior from employers in the future.

- Job reinstatement: If employees were wrongfully terminated for asserting their tip theft claims, the court may order their employees to reinstate them or give them their jobs back.

Tip theft lawsuits fall under the umbrella of employment and labor law. Employment law is incredibly complicated. The financial compensation available will depend on the laws and regulations applicable to the industry and the specific circumstances of the tip theft case.

Consult with an experienced wage and hour attorney who has experience in wage and tip theft cases. They can help you understand the types of compensation that can be pursued in your lawsuit and help you seek just compensation for your tip theft losses.

A wage and hour lawyer is an attorney who represents employees in legal matters related to their wages, tip issues, and other labor-related issues. These lawyers focus on enforcing state and federal labor laws that govern how employees need to be paid for their work — including minimum wage requirements and tip disputes.

Contact The Lyon Firm online or by calling our office at (513) 381-2333. Our team is here for you and is ready to help you begin the legal process.

Understanding Employment Law: Employer Stealing Tips

Understanding employment law is very important when it comes to protecting your rights and ensuring fair treatment in the workplace. Employment law clearly dictates that tips received by service employees belong exclusively to the individuals who earn them.

However, instances arise where employers unlawfully withhold or misappropriate these tips, violating the rights of their employees. Such actions not only violate federal and state labor regulations but lead to employers taking unfair advantage of their employees.

When employers engage in tip theft schemes, they unlawfully seize earnings that rightfully belong to their employees, depriving them of income and disregarding their hard work. Employees who find themselves in situations where their tips are being withheld or misused by their employer may have legal recourse to seek justice and recover their rightfully earned compensation.

Is It Illegal To Withhold Tips From Employees?

An employer withholding tips is a form of wage theft. Employers who unlawfully withhold tips from employees may be subject to legal action, including lawsuits and financial penalties.

Employees who believe their tips have been unlawfully withheld by their employer may have grounds to pursue legal action. This may include filing a complaint with the Department of Labor or filing a lawsuit with the help of an employment law attorney.

It is important for workers to be aware of their rights regarding tip income and to take action if they suspect their employer is engaging in tip theft or other unlawful practices. If your employer has engaged in any of the following practices, you may have experienced tip theft:

- Tip skimming: Employers may directly take a portion of tips collected from customers before distributing them to employees. This can involve deducting a percentage of tips as an “administrative fee” or taking tips to offset business expenses.

- Tip deductions: Some employers may unlawfully deduct tips from employees’ wages for various reasons. These reasons may include customer walkouts, breaks, or till shortages.

- Service charges misrepresentation: Employers may impose mandatory service charges or gratuities on customer bills and fail to distribute these funds to employees as tips. Instead, they may retain the service charges as revenue or use them to cover operational costs without the knowledge or consent of employees.

It can be difficult to report an employer stealing tips — especially if you enjoy your job and get along with your employer. Yet, it is important to hold parties responsible for wage theft accountable for their actions. You can report an employer stealing tips by filing a complaint with the Department of Labor. You can also consider a lawsuit against your employer for withheld tips, back pay, and other compensation.

By filing tip theft lawsuits against those who have broken employment laws, you are helping to promote a safe work environment for all.

Contact an Experienced Wage and Hour Lawyer

A wage and hour theft lawyer from The Lyon Firm can assess the specifics of your situation and advise you on your legal rights and options for pursuing a claim against your employer. Your lawyer can file a lawsuit on your behalf to recover unpaid wages and other damages.

Why Hire The Lyon Firm

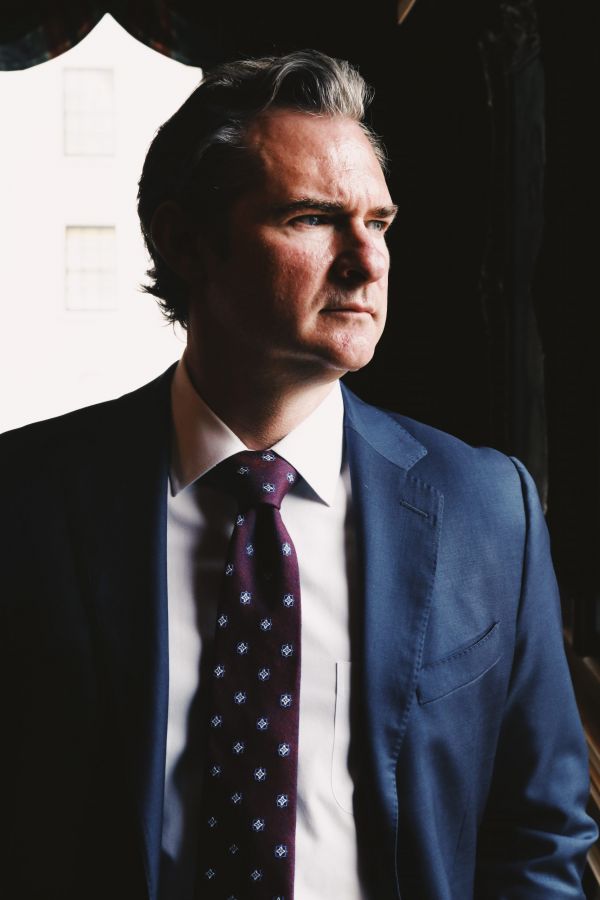

Joe Lyon and the attorneys at The Lyon Firm have many years of experience in handling wage theft and tip withholding issues. Our team has won numerous victories for our clients across different types of law — including employment law.

Contact The Lyon Firm online or by calling (513) 381-2333. Employment law and tip theft lawsuits are highly complicated and you should not try and handle one on your own. We are standing by to answer your questions and help you set your case up for the best chance of success.

CONTACT THE LYON FIRM TODAY

Please complete the form below for a FREE consultation.

ABOUT THE LYON FIRM

Joseph Lyon has 17 years of experience representing individuals in complex litigation matters. He has represented individuals in every state against many of the largest companies in the world.

The Firm focuses on single-event civil cases and class actions involving corporate neglect & fraud, toxic exposure, product defects & recalls, medical malpractice, and invasion of privacy.

NO COST UNLESS WE WIN

The Firm offers contingency fees, advancing all costs of the litigation, and accepting the full financial risk, allowing our clients full access to the legal system while reducing the financial stress while they focus on their healthcare and financial needs.

Class Action Tip Theft Lawsuits

Without wage theft class actions, large employers and corporate defendants would be able to cause harm over a large group of individuals without any risk of financial penalty.

CONTACT THE LYON FIRM TODAY

Questions: Tip Theft Litigation

It is difficult to give an exact timeline for a tip theft lawsuit. The duration of a tip theft lawsuit can vary widely depending on several factors including:

- The complexity of the case

- The willingness of the parties to agree to a settlement

- Court scheduling, and the backlog of cases in the jurisdiction where the lawsuit is filed

Some cases may be resolved relatively quickly through settlement negotiations, while others may take several months or even years to reach a resolution, particularly if they proceed to trial. It is important to discuss the specifics of your case with your attorney, who can provide a more accurate estimate of the timeline based on the circumstances involved.

Class action lawsuits can be an effective way to achieve justice for a large number of people who have experienced similar harm. However, class action lawsuits are not appropriate for every type of case.

An experienced employment law attorney can assess the merits of your potential class action lawsuit and evaluate whether class certification is feasible. Class action lawsuits can be complex and require careful planning and preparation to be successful.

The Lyon Firm has successfully handled many class action lawsuits, including a delivery driver reimbursement case. Our team is standing by to answer your questions about class action lawsuits and help you determine if joining a class action lawsuit is right for you.

Retaliating against an employee for engaging in protected activity, such as filing a lawsuit or complaining about wage and hour violations, is illegal under federal and state labor laws.

Take any allegations of retaliation seriously and seek legal advice promptly if you believe you have been retaliated against for exercising your rights under employment laws. An experienced attorney can help you understand your options and work to protect your legal rights and interests.

If you feel unsafe or threatened as a result of retaliation by your employer, you should consider seeking protection, such as a restraining order or other legal remedies, to ensure your safety and well-being.

You should consider hiring a wage and hour theft lawyer if you believe that your employer has violated your rights under state or federal labor laws. This may include issues such as an employer paying you incorrect wages, unpaid wages, minimum wage violations, overtime pay violations, or tip theft.

Depending on the type of wage violation you have experienced, different statutes of limitations may apply. The statute of limitations refers to the window of time during which you are allowed to file a lawsuit. It is important to act promptly if you believe your rights have been violated.

An attorney will be able to properly evaluate your case and help determine which employment laws have been violated. They will then be able to help you file a timely lawsuit with the court.

Contact The Lyon Firm online or by calling (513) 381-2333 to learn more about specific labor laws and how an attorney can help you pursue a tip theft lawsuit.

-

-

Answer a few general questions.

-

A member of our legal team will review your case.

-

We will determine, together with you, what makes sense for the next step for you and your family to take.

-